- Ifinance 4 review software#

- Ifinance 4 review trial#

- Ifinance 4 review plus#

- Ifinance 4 review professional#

- Ifinance 4 review free#

For complete list of fees, visit M1 Fee Schedule.

Ifinance 4 review plus#

Other fees may apply such as regulatory, M1 Plus membership, account closures and ADR fees. Brokerage products and services are offered by M1 Finance LLC, an SEC registered broker-dealer, Member FINRA / SIPC.Ĭommission-free trading of stocks and ETFs refers to $0 commissions charged by M1 Finance LLC for self-directed brokerage accounts. Nothing in this informational site is an offer, solicitation of an offer, or advice to buy or sell any security and you are encouraged to consult your personal investment, legal, or tax advisors.īrokerage products and services are not FDIC insured, no bank guarantee, and may lose value. Using M1 Borrow’s margin account can add to these risks, and you should review our margin account risk disclosure before borrowing. Past performance does not guarantee future performance. M1 Plus is an annual membership that confers benefits for products and services offered by M1 Finance LLC and M1 Spend LLC.Īll investing involves risk, including the risk of losing the money you invest. M1 Holdings is a technology company offering a range of financial products and services through its wholly-owned, separate but affiliated operating subsidiaries, M1 Finance LLC and M1 Spend LLC. M1 refers to M1 Holdings Inc., and its affiliates. M1 relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. All agreements are available in our Agreement Library.

Ifinance 4 review professional#

With the help of a professional analytics team and with an accurate analysis of all the different platforms in the world of economics. M1 Visa® Debit Card is issued by Lincoln Savings Bank, Member FDIC.īy using this website, you accept our Terms of Use and Privacy Policy and acknowledge receipt of all disclosures in our Disclosure Library. The site brings the most reliable reviews from the world of investment and economics. M1 Spend checking accounts furnished by Lincoln Savings Bank, Member FDIC.

Ifinance 4 review free#

Upon expiry of the Free Trial, your account is automatically billed an annual subscription fee of $125.00 unless you cancel under your Membership details in the M1 Platform.Ĩ M1 is not a bank.

Ifinance 4 review trial#

1.5%-10% credit card cash back rewards earned on eligible purchases subject to a maximum of $200 cash back per calendar month.ħ Your free trial (a $31.25 value) begins the date you enroll in the M1 Plus subscription, and ends 90 days after (Free Trial).

Review Cardholder Agreement for more details. Obtained from the FDIC.ĥ 1.5%-10% credit card cash back rewards earned on eligible purchases subject to a maximum of $200 cash back per calendar month.Ħ The Owner’s Rewards Card by M1 is Powered by Deserve and issued by Celtic Bank, a Utah-Chartered Industrial Bank, Member FDIC. National average is 0.03% APY as of June, 2022. Rates may vary.Ĥ No minimum balance to open account or to obtain APY (annual percentage yield). Not available for retirement and custodial accounts.

Ifinance 4 review software#

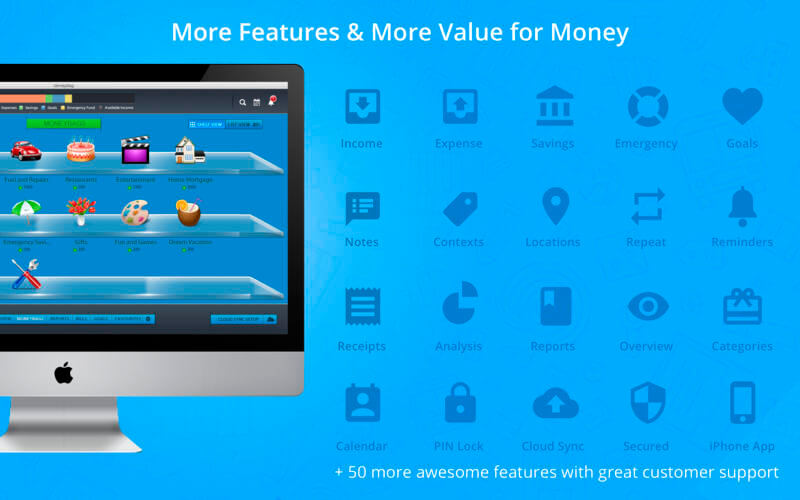

iFinance is available in a variety of popular languages spoken around the world, including English, German, French, Portuguese, Russian, Chinese and more.3 M1 Borrow available on margin accounts with a balance of at least $2,000. This software is quite helpful for the novices in financial matters and helps them a lot in budgeting, tracking and managing their finances.

Moreover, it keeps all the user devices up-to-date using iCloud or enhanced WiFi Sync feature. iFinance is compatible with a variety of banking file formats like QIF, OFX, CSV or mt940 allowing users to import data and get a detailed overview of multiple transactions from a single place. Another useful feature of the software is that it showcases the areas where there’s potential for savings and enables people to review their financial goals based on the particular metrics. Great looking app, but doesnt have direct access so requires a lot of work to get all of your accounts in one program. It produces various charts and reports after analysing users’ finances and offers a detailed overview of their biggest spending areas as well. The software enables users to arrange transaction lists of all their financial resources, from debit account to credit card and cash, in order to monitor the spending habits of their own.

IFinance is a finance management software that helps people to keep track of their income and spendings in a fast and convenient way.

0 kommentar(er)

0 kommentar(er)